2025-26 MBA Admissions: Trends Defining the Class of 2028

October 1, 2025

Read MoreOctober 8, 2025

For many years, an MBA’s allure rested on the reputational boost from globally recognized business schools. Yet, in 2025, the conversation has fundamentally changed: applicants in every round are scrutinizing MBA programs far beyond just rankings and logos. Today’s MBA aspirant is laser-focused on the program’s return on investment (ROI)—especially post-graduation salaries, employment rates, and value alignment—rather than relying solely on the cachet of “prestige”. Below, we break down what this shift means and why ROI is more central than ever in discerning business school value.

ROI for MBA programs measures the tangible career gains relative to total degree cost. This involves tuition, fees, living expenses, foregone salary during school, and any associated loans. Yet, modern candidates know ROI is more than just dollars in and dollars out – it includes career mobility, networking, and long-term value alignment as well.

Tuition and cost-of-living at top programs can exceed $200,000, while student debt and higher borrowing rates have deepened applicant caution. Rising costs have outpaced average salary growth in some elite programs, narrowing the “pay edge” MBAs command over non-MBAs. Candidates crave assurance that returns—measured in both salary and opportunity—justify the up-front expense.

Schools increasingly release granular employment and salary data by industry, region, and function. Applicants no longer accept aggregate averages; they demand specifics about the roles, companies, and cities where graduates land. For instance, while Harvard MBAs report total compensation nearing $256,000 within three years, other schools like the University of Georgia (ranked 29th) post the highest ROI salary-to-debt ratios in the U.S., up to 6.6:1.

The Graduate Management Admission Council’s 2025 survey confirms that ethical leadership, values fit, and skill-building are just as important as brand. The majority of applicants strive for programs where the mission matches their own ambitions, allowing for a more personalized (and potentially more sustainable) ROI.

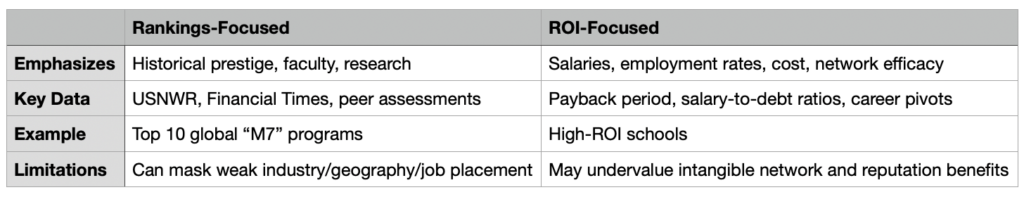

MBA rankings aggregate factors like peer reviews, faculty research, and historical reputation. But ROI-driven analysis asks:

Applicants run data-driven analyses:

Prestige and rankings hold some sway, but 2025 MBA applicants are overwhelmingly focused on ROI: they want to know not just “where is the best school?” but “which school will best equip me for my personal definition of success?” This means examining data, asking better questions, and sometimes choosing less traditional paths for greater financial—and personal—rewards. As costs rise, and the world changes rapidly, ROI isn’t just king; it’s the essential toolkit for making one of the biggest decisions in a career.

Take the next step towards maximizing your MBA ROI by working with the experts at Admitify. With decades of admissions experience and a proven record of getting clients admitted to top programs, Admitify’s team will guide you through every stage of the application process – from strategic profile positioning to essay development and interview prep. Book your free profile review with Admitify today and get personalized insights to help you choose the right program, strengthen your application, and achieve your business school goals.

Choosing the right MBA program in 2025 involves more than evaluating prestige or rankings – it requires a clear understanding of ROI, costs, and career outcomes. Applicants and current students have many questions about how to measure MBA ROI in today’s economic environment, the impact of program choice, and practical strategies for maximizing post-graduate success. Below are answers to some of the most frequent questions about MBA ROI in 2025, helping clarify what applicants should watch for and how to make the smartest investment in their career. ROI stands for “return on investment,” measuring the overall benefits (usually financial and career) of earning an MBA compared to all the costs incurred, such as tuition, fees, living expenses, and foregone salary during studies. The simplest formula: (Post-MBA Salary−Pre-MBA Salary)×Years−Total MBA Cost Additionally, experts often calculate payback period – the time it takes to recoup the cost of the degree through increased earnings. Lifetime ROI can range from $500,000 to more than $1 million depending on career track, industry, and location, as it reflects long-term salary increases, career advancement, and expanded opportunities. Major factors include: Not necessarily. Some mid-ranked or regional schools boast excellent salary-to-debt ratios and strong career placement, especially in fast-growing sectors or regional markets. MBA yield refers to the percentage of admitted students who choose to attend a program, indicating both popularity and perceived value. High yield often signals strong ROI and fit among applicants. Online and executive MBAs can offer higher ROI for many professionals by allowing continued employment during study, lower costs, and flexible learning; however, outcomes depend on program quality and individual career goals. Most graduates from top programs recoup their investment in 2–5 years. Regional or lower-cost programs can have even faster payback periods when salary increases are substantial and debt burdens are minimized. For candidates seeking to accelerate career growth or switch industries, an MBA often delivers strong ROI. For others, especially those with less dramatic salary growth potential, careful analysis is needed to ensure the benefits outweigh the costs.FAQs: MBA ROI